ev tax credit 2022 texas

Tax Credit For Electric Vehicle Chargers Enel X Latest On Tesla Ev Tax Credit January 2022 Tips For Electric Vehicle Drivers In Texas. Federal Tax Credit 200000 vehicles per manufacturer.

Tips For Electric Vehicle Drivers In Texas

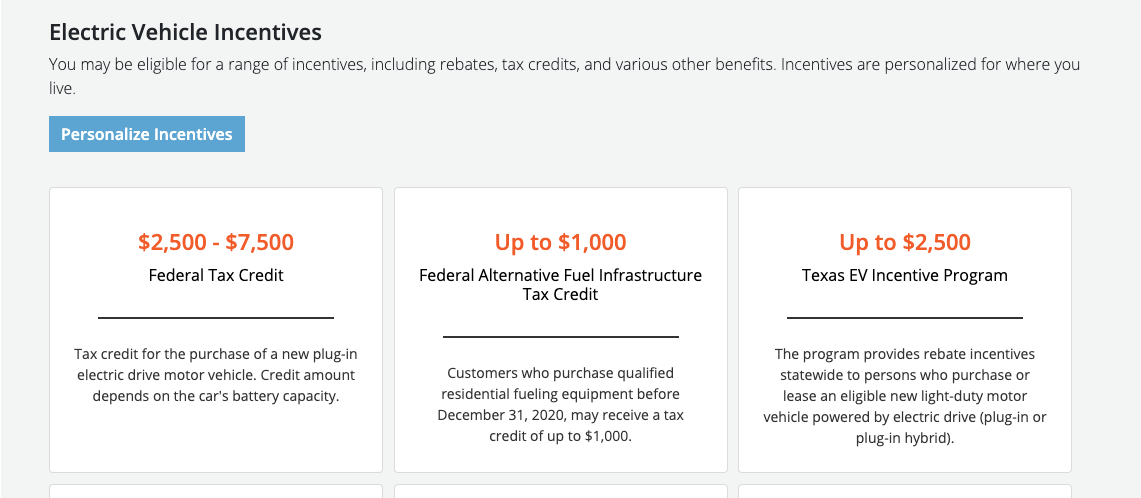

This incentive covers 30 of the cost with a maximum credit of up to 1000.

. And will Americans be able to get up to 12500 with a re-upped EV tax credit. Southwestern Electric Power Company. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Other states have. Cars SUVs and vans model-year 2011-2014. Federal Tax Credit Up To 7500.

Texas state senators are discussing a bill that would charge EV drivers between 200 and 250 for their car each year plus another 190 or more if they drive over 9000 miles. Regular Post Delivery Texas Commission on Environmental Quality Air Grants Division LDPLIP MC-204 PO. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

January 20 2022 1151 AM PST. Texas doesnt budge for Tesla. 50 of purchase and installation costs up to 500.

Prior to Jan. Tesla Getting Ready for Cyber Rodeo in Giga Texas. Dual-Motor AWD 6 to 10 months 2022 Model S Plaid 4 to 8 weeks Model 3 RWD 5 to 9 months 2022.

Express Delivery Texas Commission on Environmental Quality. If you purchase the vehicle in 2022 then you can only claim the tax credit under the then-applicable rules on your 2022 tax return next spring. Ago TaycanTurbo ETronSportback MX gone No tax filing in this year is for the 2021 tax year so only vehicles purchased in 2021 would apply.

Ev tax credit 2022 texas Sunday February 13 2022 Edit. Box 13087 Austin TX 78711-3087. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market. 2500 towards the purchase or lease of a new or used battery electric or plug-in hybrid electric vehicle. The credit is for the purchase of a new plug-in electric vehicle with at least 5kw hours of capacity.

Even an EV with a much smaller battery capacity say 16 kWh would max out the tax credit. Last Updated April 18 2022. Standard and Charge Ahead Rebates can be combined for up to 7500 toward the purchase or lease of a new eligible vehicle.

Tesla No Longer Needs the EV Tax Credit. To be eligible for a rebate under the LDPLIP a new light-duty motor vehicle must meet the eligibility standards in Texas Health and Safety Code Chapter 386 and 30 Texas. 2022 Electric Vehicle Tax Credits.

Pickup trucks model-year 2012-2014. However Tesla does not employ unionized labor so Tesla would be. White House National Climate Advisor Gina McCarthy expressed confidence on Thursday that tax credits for electric cars would survive in a reworked Build Back.

The US Federal tax credit is up to 7500 for an buying electric car. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. The IRS tax credit rewards a minimum of 2500 and may go up to 7500 so its worth figuring out how much youre eligible to receive.

Texas Commission on Environmental Quality TCEQ Light-Duty Motor Vehicle Purchase or Lease Incentive Program LDPLIP Eligible Vehicle List. The size of the tax credit depends on the size of the vehicle and its battery capacity. President Bidens EV tax credit builds on top of the existing federal EV incentive.

2022 C40 Recharge Pure Electric. 2022 C40 Recharge Pure Electric. Many EVs these days have a 100 kWh battery which would easily max out that 7500 credit.

Which EVs Hybrids Qualify. The AirCheckTexas Drive a Clean Machine Program offers up to 3500 toward replacing vehicles that are 10 years and older with cleaner-running more fuel-efficient vehicles such as. If your new EV qualifies for a government tax rebate you may be eligible for a federal income tax credit of up to 7500.

An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold. What Is the New Federal EV Tax Credit for 2022. You may submit your application via email to TERPapplytceqtexasgov or by mail to one of the addresses below on or before 500 pm CT January 7 2023.

January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. Here are the currently available eligible vehicles. The State of Texas offers a 2500 rebate for buying an electric car.

250 rebate and a tax credit for 30 of installation costs. Texas EV Rebate Program 2000 applications accepted per year. Hybrid electric natural gas vehicles model-year 2011-2014.

The federal Internal Revenue Service IRS tax credit is for 2500 to 7500 per new EV purchased for use in the US. Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline. The credit amount will vary based on the capacity of the battery used to power the vehicle.

IRS Tax Credit for Plug-In Electric Vehicles - Up to 7500. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Four Texas electric companies also offer the following incentives to residential customers who install qualifying Level 2 chargers.

Safety agencies and consumer groups warn about Tesla Vision in the Model 3 and Model Y.

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Commercial Ev Fleet Calculator And Transportation Electrification Tools

Rebates And Tax Credits For Electric Vehicle Charging Stations

Texas Solar Incentives Tax Credits Rebates Sunrun

Latest On Tesla Ev Tax Credit March 2022

.jpg)

Latest On Tesla Ev Tax Credit March 2022

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Illinois Enacts Tax Incentives To Attract Electric Vehicle Manufacturing Mayer Brown Tax Equity Times Jdsupra

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2021 Jeep 4xe Hybrid Tax Credits Incentives By State

Tips For Electric Vehicle Drivers In Texas

Potential Perks Of Owning An Electric Vehicle Farmers Insurance

Incentives Austin Energy Ev Buyers Guide

Tips For Electric Vehicle Drivers In Texas

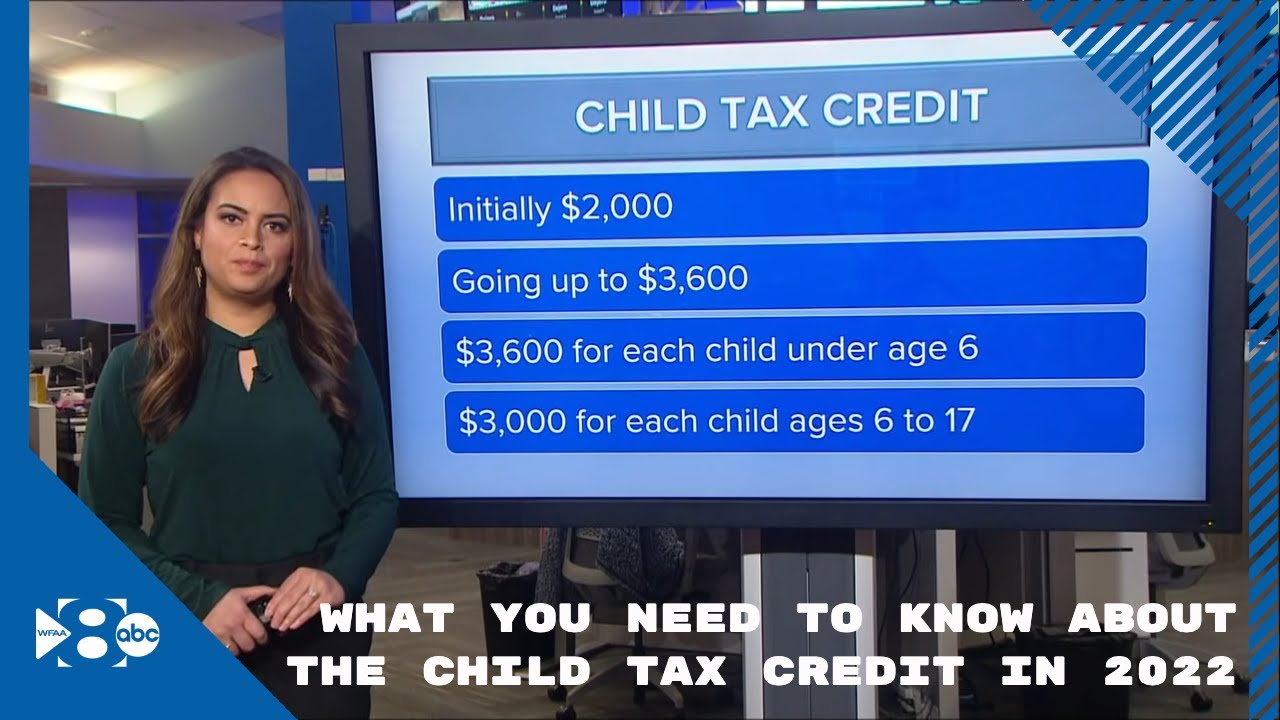

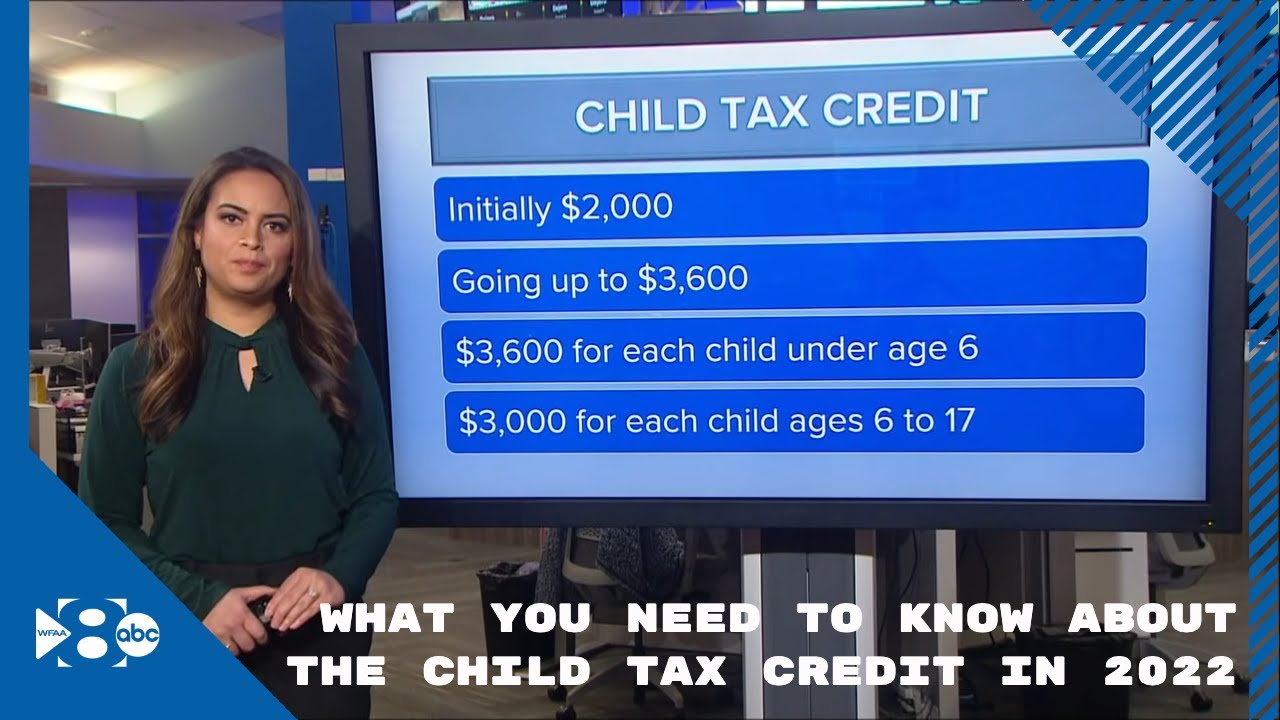

What You Need To Know About The Child Tax Credit In 2022 Youtube

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek